Tailored Plan Design for Underserved Populations in Medicare Advantage: 8 Expert Takeaways

As Medicare Advantage (MA) enrollment continues to outpace enrollment in traditional Medicare, plan providers are exploring ways to better serve diverse populations through tailored benefits and culturally competent care delivery. With more than half of Medicare beneficiaries enrolled in MA plans, the industry faces opportunities and challenges in truly meeting the needs of underserved communities while maintaining transparency and accountability in benefit delivery. Can the MA market increase health equity for seniors, or could it exacerbate existing disparities?

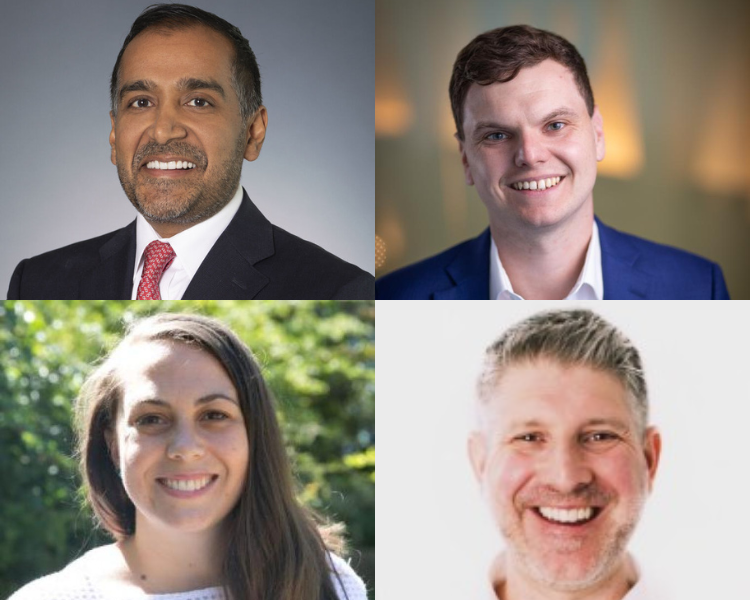

The Hopkins Business of Health Initiative recently convened a panel of industry leaders and policy experts to examine the evolution of Medicare Advantage plan design and its impact on healthcare equity and access. The discussion was moderated by Andrew Anderson, Assistant Professor at Johns Hopkins University, and featured Andy Higgins, VP of Product Development at Clever Care; Sachin Jain, CEO of SCAN Group and SCAN Health Plan; Mark Meiselbach, Assistant Professor at Johns Hopkins University; and Casey Schwarz, Senior Counsel for Federal Policy. The conversation revealed important insights about the future of Medicare Advantage and its role in serving diverse populations.

Here are 8 key takeaways from the expert discussion:

1. Tailored plans can offer customized coverage to niche populations. Aligning benefits with their cultural background, ethnicity, social risk factors, or even chronic diseases has proved highly appealing to consumers. "Folks in our communities are Korean American, Japanese American, Chinese American- you can give them $500 of traditional over-the-counter items like aspirin and ace bandages, but they may want red ginseng or herbal teas, elements of Eastern medicine that are used as a first line of treatment by billions of people across the world," said Higgins.

2. Beneficiary advocates want more transparency from providers about benefit utilization. "The scrutiny that's being applied to supplemental benefits is well deserved because there's been a lot of goodies offered to people, but frankly, some of those goodies are put behind glass, and they're actually very hard to access," said Jain. Higgins also noted that beginning in 2025, plans will be required to inform beneficiaries if they're not using supplemental benefits at midyear.

3. The breadth of choices for consumers should incentivize plans to improve. Competition between plans will naturally drive alignment with member satisfaction. "As a plan, if you're not doing the right thing by your member, not ensuring good health outcomes or satisfaction, they have a choice, right?" said Higgins. "So they will choose somebody else in the long run."

4. Financial hardship is a major driver of MA plan growth. Both Schwarz and Jain acknowledged that out-of-pocket costs for traditional Medicare have skyrocketed since the '90s. "After paying Social Security and Medicare taxes your entire life, you have the privilege of paying up to $1,000 in premiums for a family of two when you're an older adult with an income of an average income of $51,250. Medicare Advantage is trying to solve that problem," said Jain. Schwarz countered that for traditional Medicare to truly compete with MA plans on costs, reforms would need to address out-of-pocket costs in traditional Medicare or implement robust Medigap reforms that allow for much more open enrollment. "If you are talking to someone who does not have financial limitations, they are choosing traditional Medicare and a Medigap every single time," said Schwarz.

5. Medicare Advantage plans are putting pressure on traditional Medicare to evolve. "CMS still imagines itself as regulating primarily a fee-for-service program, and then there's this MA thing on the side," said Jain. "But it turns out 51% of beneficiaries are now using MA so we have to change how we do base payments, change how we do star ratings, change how we do risk adjustment."

8. …But the feedback loop between MA market advancements and traditional Medicare updates isn't necessarily working. Schwarz noted the difficulty of shared learning when data from MA plans, such as what benefits are being approved or rejected for beneficiary use, isn't accessible by CMS. "That's the bigger debate that's brewing," said Jain. "But I think this presents a real opportunity and chance for innovation."

6. Broker incentives may be a fruitful area for reform. While program navigators offer free assistance, many beneficiaries are unaware of this resource and turn to brokers who may not always prioritize their interests. "I think there are amazing brokers out there who do the right thing for their beneficiaries year in, year out, but plenty of them are just selling people into the plan that gives them the greatest commission and broker override," said Jain.

7. Plan offerings should be designed with input from providers. Jain emphasized the importance of consulting with the clinician community to direct coverage: "We partner very closely with medical groups that serve particular populations. And then we'll ask, what are the benefits that are going to resonate? What are the most important drugs? What are the supplemental benefits that are going to be most important?” He added that the feedback they get most is that who’s in your network is the most important piece–not just the right physicians but also pharmacies and ancillary service providers who can provide the desired services in the patient's preferred language.